Taler can efficiently transact

other assets

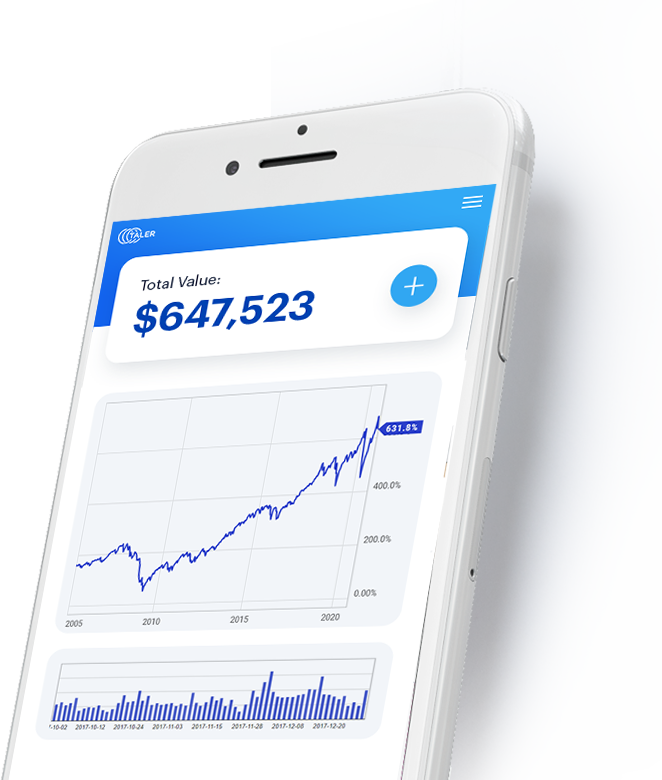

The Taler system is designed for the tokenization of any asset. It can issue secure tokens that

digitally represent a real tradable asset - in many ways similar to the traditional process

of securitization but fully electronic. The tokenization offers the potential for a world in which

transactions in assets can be handled more efficiently and with much less friction.

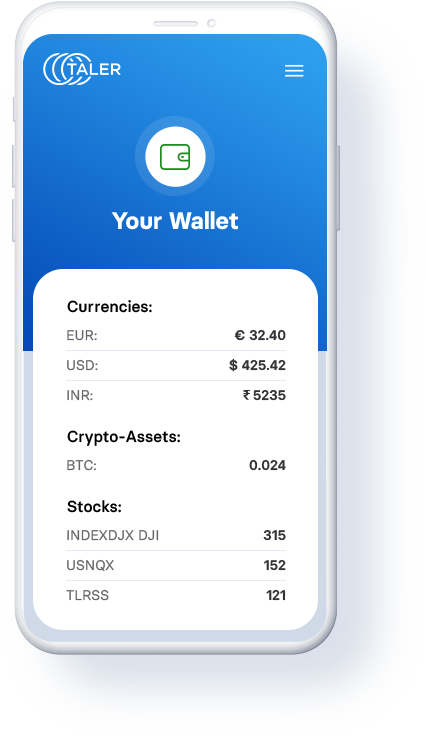

Banks and central banks can issue digital tokens to represent fiat- or crypto-currency holdings

Enterprises can issue digital tokens to represent ownership of stocks, index funds or securities

Companies can issue digital tokens for rewards programs, like airline miles or loyalty points

Banks and central banks can issue digital tokens to represent fiat- or crypto-currency holdings

Enterprises can issue digital tokens to represent ownership of stocks, index funds or securities

Companies can issue digital tokens for rewards programs, like airline miles or loyalty points

Tokenization Technology with Taler

Digital tokens provide a wide range of advantages over account-based systems:

- Instant and efficient transactions

- Direct relationship between issuer and bearer

- Provable ownership rights with owner holding tokens

- No reliance on ledger operator

Disintermediation

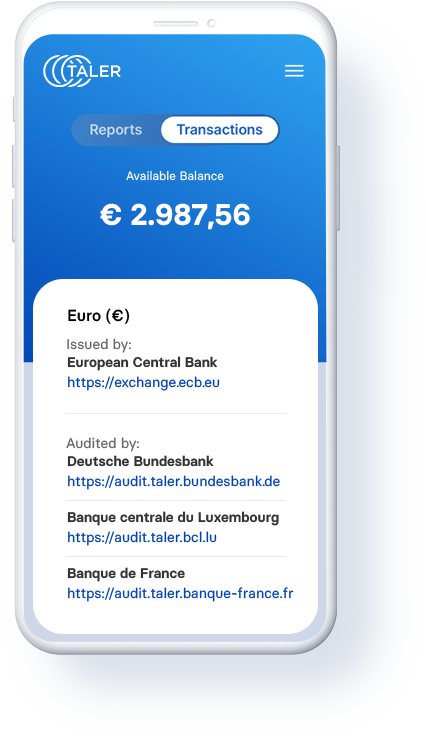

In today’s world, many assets are stored and transferred within account-based systems. For instance, bank deposits are a claim on the respective commercial bank. Should the bank go bankrupt, the depositor might lose his or her money.

In contrast, tokens in token-based systems like Taler are backed by their issuer. Taler's cryptographically secured settlement with the issuer avoids risks arising from contemporary intermediaries. Additionally, transactions become instant and more efficient since no authentication is required and costly intermediaries are eliminated.

Trust can be established via independent external auditors without exposing private consumer data to auditors.

Advantages of a value-based infrastructure

Taler is a value- or token-based system which means that the transfer occurs by granting control over the token itself, similar to paying cash with handing over of banknotes. Hence, there is no need to record ownership like in an account-based system, because possessing the token is sufficient. The tokens carry information about their value and the issuer of the token.

Ledger-based infrastructure

Distributed ledger technologies (DLTs) create more problems than they solve for a payment system:

- Limited privacy as activities are linkable via the accounts involved

- Expensive consensus mechanism limits scalability and contributes to pollution

- Slow and disintermediated transactions enable criminal abuse

Value-based infrastructure

Valuable digital tokens, like physical cash, are more suitable for payments:

- Tokens carry no history, which is necessary for privacy

- Tokens can be issued and redeemed efficiently using inexpensive cryptography

- Tokens can be signed by regulated and trusted financial institutions, creating a stable medium of exchange